Message from the Assessor

The job of the Assessor is to establish an unbiased fair, assessment of your property, and help you with any exemptions that you may qualify for…That’s basically it. The Assessor does not determine property taxes.

The job of the Assessor is to establish an unbiased fair, assessment of your property, and help you with any exemptions that you may qualify for…That’s basically it. The Assessor does not determine property taxes.

I have been in the real estate business since 1984 and an appraiser since 1986. Over these years, I have appraised well over 12,000 properties. I utilize and apply this experience and knowledge to the valuation of the town’s properties, with the goal to provide Fair and Accurate Property Assessments. You may see me from time-to-time in the town’s black-and-white car or walking the streets taking notes and pictures in order to update the town’s property records.

This office is committed to having an “open door” policy. It would be greatly appreciated that property owners make appointments in advance in order to schedule the appropriate time necessary to address your concerns. If you think the information on your property records is incorrect, we would like to hear from you so we can review the data on file of your property and make any applicable corrections. I’ll even come out to the property to confirm the dimensions, improvements, conditions, room-count, etc. if you want.

MARCH 1st is the deadline for filing or renewing ALL Exemptions

[It is strongly recommended that you apply before this cut-off date]

MAY 1st is when the TENTATIVE Assessment Roll is filed

GRIEVANCE DAY is the FOURTH TUESDAY in MAY

JULY 1st is the date when the FINAL Assessment Roll is filed

STAR (School Tax Relief)…If the property you own in Warrensburg is your Primary Residence, meaning that you live there for at least six (6) months out of the year, you may qualify for a STAR exemption. You may apply for the STAR program by contacting the Department of Taxation and Finance (DTF) at the following website: www.tax.ny.gov/star or by calling them at (518) 457 – 2036. If you are 65 or older, you may qualify for the Enhanced STAR program, which is a larger school tax exemption. If you currently have the Basic STAR, and have it on your parcel prior to 2015, you may contact this office to see if you qualify for this bigger exemption. If you applied with the DTF, they will have your age and other data on file for the Enhanced STA R and will determine if you qualify.

Senior Citizens Low Income Notice

It’s That Time Again…March 1, 2024 is the Deadline to either Apply for or Renew your existing Senior Property Tax Exemption.

If your property in the Town of Warrensburg is your “Full Time Legal Residence” (i.e. living there at least six (6) months out of the year) and you do not receive any exemptions for any other property you might own either in New York or another state, and you are at least 65 years old, or turning 65 during this year, you may qualify for an exemption that would reduce future property tax bills.

Eligibility is based on the owner’s (including spouse’s) annual income. Income includes total Social Security, Pensions, Wages, Interest, etc. The maximum amount that you can earn is $37,399 to qualify for a County exemption and $32,399 to qualify for a Town exemption. This is GROSS income, not NET income.

Applicants must provide income statements for tax year 2022 along with proof of age and residency as well as submit a completed application RP-467 which is available on-line or at our office.

If you believe you might qualify for the exemption, you may contact the Assessor’s office at (518) 623 - 3300 during business hours.

All paperwork MUST be received by the Assessor's office by no later than March 1st, 2024. Incomplete Applications WILL NOT be processed.

[NOTE: If you already receive the Senior Exemption, you can disregard this notice. Also note, this is NOT for the STAR exemption]

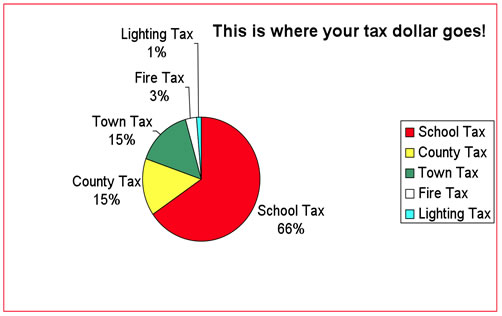

The following is a fairly close estimate / break-down of where your property tax dollars go:

Here's a web-link explaining the difference between Assessments vs. Taxes

The following example demonstrates how you can calculate the taxes you have to pay…

Year (2021) Tax Type

$13.56 School & Library [Warrensburg School District]

$ 9.18 Town / County [County, Town, Fire, Lighting]

$23.11 TOTAL

Example… Based on a $100,000 Assessment (not necessarily estimated market value that may or may not appear on the tax bill based on current equalization rates)

Assessed Value is $100,000…Divide this figure by 1,000 ($100,000 / 1,000 =) 100

100 X $22.74 = $2,274 Approximate Total Taxes

~ OR ~

$2,274 TOTAL TAX LIABILITY

[Please note that the above example is for demonstration purposes only and reflects the tax year 2021, the most current year as of this writing.]

In closing, one very important thing to understand and realize is this…

THE ASSESSOR HAS NOTHING TO DO WITH YOUR PROPERTY TAXES

THE ASSESSOR CAN NOT CHANGE YOUR PROPERTY TAXES

The job of the Assessor is to establish the FAIR, MARKET VALUE of your property, and help you with any exemptions that you may qualify for…That’s basically it. While I realize that nobody likes to pay property taxes, myself included, the Assessors office can do nothing to help you reduce them. If you don’t like the amount you have to pay, you need to take that up with your local School Board or the other entities that take your hard earned tax dollars…There is nothing this department can do about it.

Exemption Forms Online from the Office of Real Property Services

How to File for a Review of Your Assessment

Link to General Information

Uniform Percentage of Value

The percentage of market value (full value) used by an assessing unit to establish uniform assessments. This value must appear on the tentative roll. Real Property Tax Law Section 305 specifies, "all real property in each assessing unit shall be assessed at a uniform percentage of value..."

Taxable Status Date

The ownership and physical condition of real property as of this date are assessed (valued) according to price fixed as of the valuation date. All applications for property exemptions must be filed with the assessor by this date.

Residential Assessment Ratio (RAR)

A percentage established by the State Board of Real Property Services according to law, using the ratio of assessed value to the sales price for each usable residential sale in a recent one-year period. Ratios are then listed from highest to lowest; the midpoint (median) ratio is selected as the RAR. The RAR can be used to prove that a residential property is assessed at a higher level than other homes on the assessment roll. Your locality's RAR indicates at what percent of full value residential properties are assessed. For example, a RAR of 20 indicates that residential properties are assessed at approximately 20 percent of their full value.

Equalization Rate

"State equalization rate" means the percentage of full value at which taxable real property in a county, city, town or village is assessed as determined by the state board." (RPTL Section 102) The rate is a ratio of the sum of the locally determined assessed values for all taxable parcels for a given assessment roll divided by ORPS's estimate of total full value for that same roll.